AGS: How Does the Wage Guarantee Scheme Work in a French EOR Complete Solution?

Published on 2 Jun 2025

The AGS (Association for the Management of Employee Wage Claims Guarantee Scheme) is a mechanism designed to protect employees’ remuneration when their employer becomes insolvent.

But how exactly does this system work? How does it apply within a French EOR complete solution? What are the conditions required to benefit from it, and which amounts are covered?

2i Portage explains everything you need to know about how the AGS works in a French EOR Complete Solution.

What Is the AGS?

The Wage Guarantee Scheme was created in 1974 to secure the payment of amounts owed to employees—salaries, paid leave compensation, notice pay, severance payments, etc.—when their company enters collective insolvency proceedings (safeguard, receivership, or liquidation).

It is funded through a mandatory employer contribution, collected by Urssaf at a rate of 0.25% of salaries, capped at four times the monthly Social Security ceiling (€15,700 in 2025).

This means that all private-sector employers must contribute, with no exceptions.

As private employers, French EOR entities are also required to pay this contribution to protect the consultants they employ.

Who Can Benefit From the AGS?

The AGS covers all employees with an employment contract, regardless of their seniority:

- Permanent or fixed-term contracts, full-time or part-time

- Apprentices and temporary workers

- Employees posted or expatriated abroad

Only executives without an employment contract (such as SAS company presidents) are excluded from the scheme.

How Does the AGS Work?

The AGS activates its guarantee only if the employer:

- Is subject to safeguard, receivership, or judicial liquidation proceedings

- Is demonstrably unable to pay the amounts owed to employees

Once both conditions are met, a court‑appointed receiver (mandataire judiciaire) steps in to manage the collective proceedings.

Good to know: Employees do not need to take any steps— the court‑appointed receiver handles everything.

Still unclear? Let’s take a closer look at the AGS process.

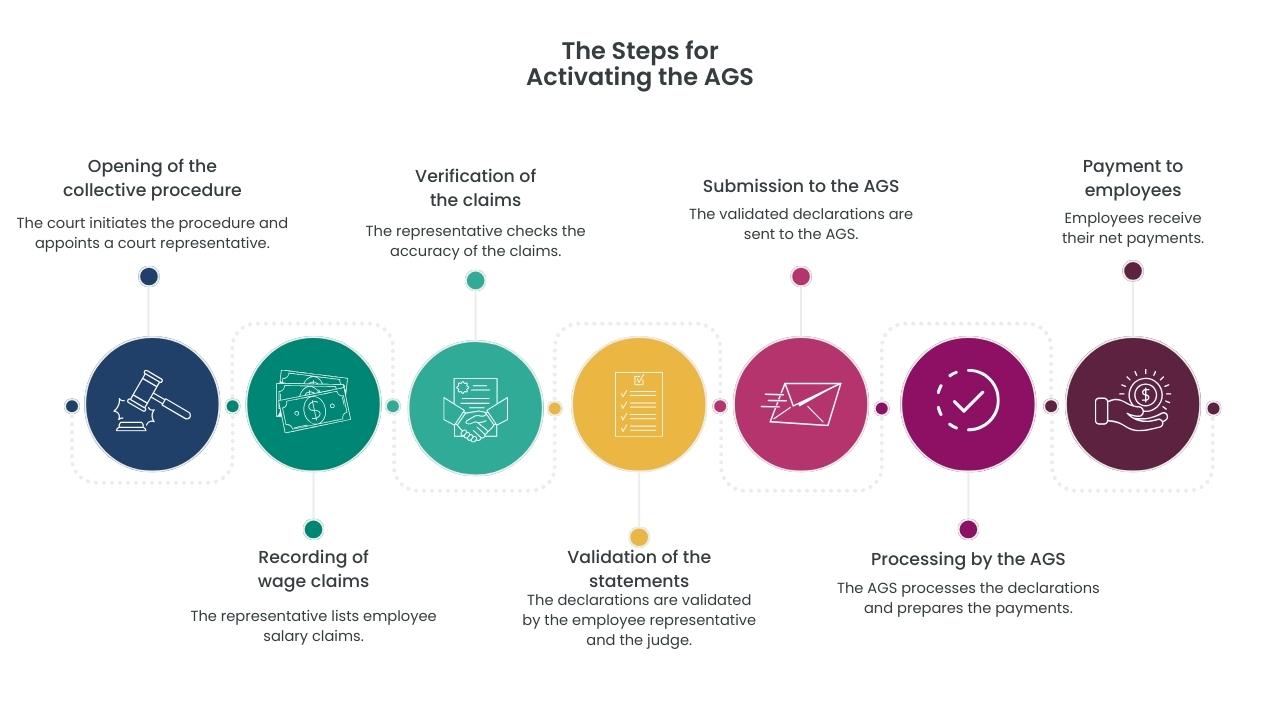

What Are the Steps to Benefit From the AGS?

Activating the AGS follows a precise sequence of steps.

1. Opening of Insolvency Proceedings and Appointment of the Court Appointed Receiver

When proceedings begin, the court immediately appoints a receiver.

This independent professional represents the interests of creditors—particularly employees—throughout the entire process.

- Identification of Wage Claims

The receiver must then compile detailed wage‑claim statements, listing all amounts owed to each employee:

- Paid leave compensation

- Salary

- Notice pay and severance payments

- Damages for unfair or unjustified dismissal

- Etc.

To do so, the receiver uses company documents (employment contracts, payslips, final settlement statements, etc.) and information provided by employees and staff representatives.

- Verification of Claims and Creation of Final Statements

After identifying the claims, the receiver verifies each amount by cross-checking available sources.

The final wage claim statement includes:

- Employee identity

- Contract type

- Employment start and end dates

- Detailed list of payable amounts

- Validation of the Claims

Before the statements can be sent to the AGS, they must be approved by:

- The staff representative

- The supervising judge (juge‑commissaire)

This double validation ensures the accuracy and legitimacy of the claims.

- Transmission to the AGS

Once validated, the statements are forwarded to the relevant AGS regional office, which then reviews the file and prepares payment.

This one will then be able to review the requests and reimburse the amounts advanced.

- AGS Review and Payment

Upon receiving the claims, the AGS has short legal deadlines to advance the funds:

- 5 days for “super‑privileged” claims (last 60 days of salary)

- 8 days for all other claims (paid leave, notice, severance…)

The AGS transfers the funds to the receiver, who then pays the employees.

- Payment to Employees

The final step: the receiver pays employees their net amounts (after employee contributions).

They usually receive:

- Net salary

- Paid leave compensation

- Any termination related payments (notice, even if not worked).

End of contract documents (work certificate, unemployment certificate, final settlement receipt) are also provided.

From the opening of proceedings to payment, the average timeframe is around one month—short considering the complexity involved and demonstrating the efficiency of the AGS system.

Good to know: Employees have 2 months after publication in the BODACC to contest their wage‑claim amounts before the labor court. After this, claims become final.

While the employee plays no active role in the process, they must remain vigilant and responsive, staying in close contact with the receiver and staff representative to ensure their rights are upheld.

Which Amounts Does the AGS Cover?

Amounts covered by the AGS vary depending on the type of insolvency but generally include:

- Salaries for the last 60 days

- Paid leave on those salaries

- Notice pay, severance, and early termination of fixed term contracts

- Damages for unfair dismissal

Coverage is capped depending on seniority:

| Seniority | 2025 Cap |

| Under 6 months | €62,800 |

| 6 months to 2 years | €78,500 |

| Over 2 years | €94,200 |

Other Guarantees in a French EOR Complete Solution

Beyond the AGS, professionals working through a French EOR complete solution benefit from protections linked to their hybrid status—independent yet employees.

These include the mandatory financial guarantee and professional liability insurance (RC Pro).

The Mandatory Financial Guarantee

A specificity of the French EOR model, the mandatory financial guarantee ensures payment continuity in case the French EOR encounters financial difficulties.

2i Portage has successfully renewed its financial guarantee following audit!

Although similar to the AGS, it should not be confused with it:

- The AGS applies to all private-sector employers

- The financial guarantee applies exclusively to French EOR entities

It must be issued by a bank, an insurance company, or a mutual surety company.

The legal minimum amount is:

- Twice the PASS (Annual Social Security Ceiling)

- 10% of the previous year’s total payroll

If the French EOR faces financial hardship, the guarantor steps in to ensure:

- Payment of each consultant’s salary

- Payment of termination related amounts (notice, severance, paid leave)

- Reimbursement of business expenses

Combined with the AGS, this guarantee ensures maximum security for professionals using a French EOR complete solution.

Professional Liability Insurance (RC Pro)

Mandatory for all French EOR entities, professional liability insurance covers damage caused by consultants to clients or third parties:

In practical terms, Professional Liability Insurance applies in the following situations:

- Bodily injury

- Property damage

- Financial loss (e.g., business interruption, reputation damage)

- Professional faults (poor execution, delays…)

The French EOR holds a global policy covering all consultants, ensuring they:

- 1. Benefit from full financial protection

- 2. Maintain healthy client relations by avoiding direct conflict

- 3. Reassure clients with a high standard of reliability and professionalism

This protection is essential for consultants, especially in high risk sectors (consulting, engineering, IT…).

Why Choose 2i Portage?

A pioneer of French EOR in France with over 15 years of expertise—and a specialist in IT, support functions, and interim management—2i Portage offers its consultants:

- An all inclusive package with onboarding in under 24 hours

- Transparent and fixed management fees of 6%

- Secure salary payments on the 1st of each month

- A dedicated advisor specialized in salary engineering

- Revenue optimization solutions enabling up to 60% take home pay

And above all, 2i Portage is PEPS/AFNOR certified, guaranteeing high‑quality service meeting strict standards.

In short: choosing a French EOR complete solution with 2i Portage means being fully protected while carrying out your activity in the best possible conditions.

In the same category

Succeeding with you, step by step